Table of Content

It is meant to satisfy the member's immediate credit needs. The lower and middle classes can now own their dream homes thanks to Pag-housing IBIG’s loans, including rent-to-own homes. The property seeker must first be a Pag-IBIG member with at least 24 months of contribution in order to be eligible for the organization’s programs. Pag-IBIG payments are typically included in the list of obligatory perks that employers must provide to their staff. There is a voluntary donation option available to self-employed people.

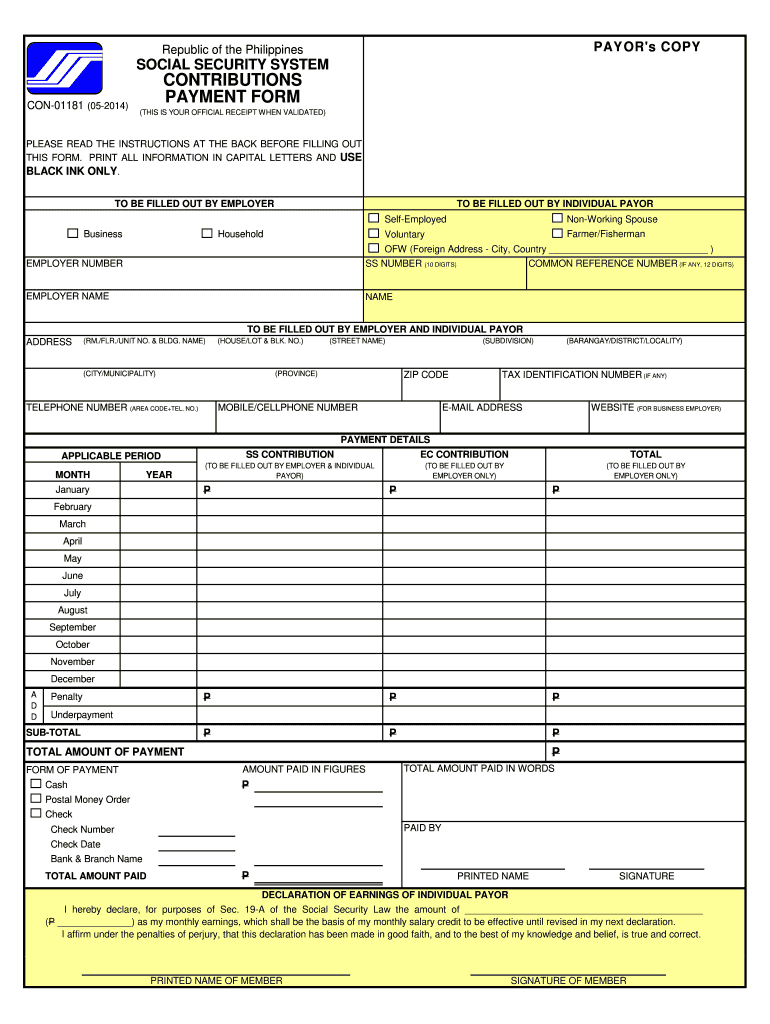

The P300 extra charge will be shouldered by the employer. As per Regino, the increase was in accordance with Republic Act 11199, which the late President Rodrigo Duterte signed. According to the aforementioned law, the SSS contribution rate will rise by 1% a year from 2019 to 2025. Meaning, members’ contributions will reach 15% by 2025. Omnibus Line– This feature allows the borrower to get different loan offers.

How to apply for the SSS business loan?

A one-month loan is equivalent to the average of member’s last twelve Monthly Salary Credits , or the amount applied for, whichever is lower. A processing fee equivalent to 1/2 of 1% of loan amount of Php500 whichever is higher, but not exceeding Php 3,000 will be deducted from the first loan release. There will also be an inspection fee of P500 to be shouldered by the borrower. Borrower and spouse is updated in the payment of their other SSS loan, if any.

Therefore, the High-Density Housing Program was established by the SHFC . Their main objective is to give ISFs living in the National Capital Region safe, flood-free housing . There are plenty of different reasons why starting a business can be extremely challenging, but the most frequent and complicated is financing. If you are an SSS member and in need of financial assistance, you may apply for a Salary Loan at any SSS branch office near you.

What is an Target ETL Salary?

You can borrow anywhere between PHP10,000 and PHP1,000,000, depending on your monthly income and financial requirements. To avail of any of these loan options, the OFW must have been working abroad for at least 2 years with a monthly income of P50,000 for the Auto Loan and P10,000 for all other OFW loan types. Moreover, borrowers must be 25 years old or older but not more than 65 years old upon loan maturity. Learn more about the available options for OFW Loans from BDO here. There are many banks to choose from when it comes to home loan financing. One of the best ways to get started with deciding where to get a bank loan is to do research on various financial institutions that interest you or with the ones you’re currently using.

You should try and keep hold of your valuables, and when there’s no other way – short term loansare there to save you. SSS Salary loans are a great help in times of need for working people. Once the application has been approved, the member will be required to pay an upfront fee of 2% of the loan amount.

LandBank OFW Loan

An SSS Housing Loan is issued by the Social Security System, a state-run social insurance program. SSS Housing Loans are not as common as Pag-IBIG Housing loans, but still carry many benefits. One of the ways SSS gives thanks to members who make recurrent contributions is by offering a loan program.

As mentioned above, non-OFWs are allowed to apply for home loans but only for the purpose of house repairs and improvements. It is a lending program available either directly from SSS or through its accredited participating financial institutions . The loan shall be secured by a first Real Estate Mortgage on the house and lot to be financed. The REM shall be annotated on the member-buyer’s TCT and shall be registered with the appropriate Registry of Deeds.

Fintech Company Workhy Helps Entrepreneurs Start and Run Businesses Online

Yes, you can apply for SSS benefits even if you don’t have a job. However, you will need to meet certain requirements and provide supporting documents. To learn more about how to apply for SSS benefits, visit their website or contact their customer service hotline.

The only limitation of this feature is that OFWs can only be granted this SSS housing loan once. However, you can still qualify for SSS’ home loan even if your spouse has availed of it prior to marriage, as long as the OFW Loan is not delinquent. The first step in your home buying journey is to use a mortgage calculator. It’s usually a free, online tool that will help you determine how much financing you could qualify for. After you have an idea of how much financing you will need, it’s time to pick a lender.

A 1% penalty could be imposed if the loan is not repaid on time. It should be noted that a person can only re-apply for a loan once the loan has been paid off for 24 months and that there may be an additional fee of ₱500 before the new loan can start. The institution is aware that OFWs struggle to save money for their families.

Utilize a tool such as a home loan calculator to get an estimate of how much you could finance with a bank. If your loan is approved by the PFI, you are subjected to an amortization schedule that is payable either monthly, quarterly, semi-annually, or annually. The maximum term is 15 years with a grace period of three years on principal payment.

The member must also be updated in the payment of other loans with SSS. An Educational loan is extremely important for youngsters who want to study or parents who want to send their kids to school or college but cannot afford it. They can opt for educational loans to complete their education by paying back the money gradually.

The other explanation is that your debt-to-income ratio is too high. Divide your total monthly debt payments by your gross monthly income to arrive at this percentage. To ensure house loan approval, it is better tochoose a property that fits your salary.

How Can You apply for Social Security System Loan (SSS loan) in the Philippines?

Flexible loan amounts, from Php 30,000 to Php 2,000,000. To be eligible for this loan, OFW members must be 21 years old and no more than 60 years old on loan maturity. We send you tips & deals that will save you time and money. Your need based on the type of work you wish to complete and materials evaluated by the SSS. Following are some requirements you must fulfill to apply for any SSS loan, depending on your occupation. The SSS-accredited PFI you have selected may affect the requirements and processing flow.

This calculator takes into account your current monthly salary, age, and contribution history to provide you with an estimate of the maximum loanable amount. Simply enter your information into the calculator below and click “Calculate” to see your results. If with an existing member loan, must be up-to-date in amortization payments in all member loans including housing loan with the SSS at the time of filing of application for repair and/or improvement. If existing housing loan is restructured, a copy of the Supplemental Mortgage Contract shall be submitted. Personal loans are often used for a variety of reasons.

No comments:

Post a Comment